We are witnessing the heralding of a new era in the e-commerce industry thanks to the sudden ubiquity of 3G & 4G providers competing with each other. The increased penetration of Internet Service Providers all over India has made this a reality. This has also rendered the cost of using the Internet a lot more affordable and provided a huge fillip to the m-commerce and e-commerce markets in India. In the years to come, this is only going bound to get better as more and more people have now resign themselves to shopping from the creature comforts of their own houses.

If you have just set up your online shop or e-commerce venture, the success of your venture completely depends completely on how easily you can enable payment options for the consumption of your goods and services which in turn is dependent on mainly two factors:

- Choosing the appropriate payment gateway provider that can fit your budget and get you started ASAP.

- Completing the entire Payment Gateway Integration seamlessly without any hiccups.

In order to evaluate the payment gateway providers, I have set up some parameters based on which we can evaluate them. My params are actually pretty straightforward, am going to explain them briefly so that we are all on the same page.

- Setup Fees: What is the one-time fee that they will charge you to set up your account?

- Annual Fees: What is yearly fee that they will charge you for maintenance?

- Transaction Fees: What is the fee per transaction?

- Multiple currency support: Are currencies other than the Indian Rupee supported?

- Local Credit\Debit Cards Supported: Are local Credit and Debit cards are accepted?

- International Credit\Debit Cards Supported: Are International credit and debit cards are accepted.

- Net Banking: Does it support Netbanking ?

- Activation Time: How many days do they take to activate your account?

- Settlement time: What is the typical time taken by them to settle your payments?

- Customer Support: Kind of post-sales support you receive from them?

- Integration effort: Time and effort needed to complete a sample integration with them.

- Advanced Features: Support for features like Card Tokenization and Recurring Payment options, Sandbox testing?

- Technical Documentation on site for review: Documentation that you can review before signing up with them.

I have reviewed around 5 of the most popular ones around based on the above params.

Instamojo

Briefly, Instamojo.com is a digital payments platform that comes bundled with tons of e-commerce features to enable any business or individual to sell, manage & grow effortlessly, securely and cost-effectively. Our platform is built upon existing financial infrastructure of bank accounts, credit cards or other digital payment instruments to create a pervasive & persistent real-time payment solution. They deliver a product that's ideally suited for Indian SMB's, online merchants, individuals and others currently underserved by traditional payment mechanisms.

| Annual Fees: | No Annual Fees |

|---|---|

| Transaction Fees | Ranges from 2.0% + 3.00 Rs to 3.00% + 3.00 Rs |

| Multiple currency support | They don't support multi-currency payments. |

| Local Credit\Debit Cards Supported | Yes  |

| International Credit\Debit Cards Supported | Yes, you need to ask for it though. |

| Netbanking support | Yes, commonly used banks are supported  |

| Activation Time | You can get started immediately, all it requires is a basic signup with your business details (PAN no., Bank Account and Mobile no). |

| Settlement time | It takes around 3 days from the day you initiate the transaction |

| Customer Support | Pretty decent, haven't faced any issues with their customer service. if you do a Google Search though you might see tons of negative reviews. Ideal for small businesses. |

| Integration Effort | It's fairly simple, should be done within a day, they offer plenty of examples in various languages on how this is to be done, they actually offer this information upfront which is a big + point. |

| Advanced features | They seem to support neither "Recurring Payments" nor "Tokenization" of cards. They do however support a Sandbox for testing purposes which is good. |

| Technical Documentation on site for review | They provide sufficient documentation for you to complete the integration with minimal effort. |

Razorpay

Razorpay is a payment gateway founded by alumni of IIT Roorkee. They accept and validate Internet payments via Credit Card, Debit Card, Net Banking and wallets. providing a secure link between your website, various issuing institutions, acquiring Banks and the payment gateway providers.

| Setup Fees | No setup fees |

|---|---|

| Annual Fees | No Annual Fees |

| Transaction Fees | Varies from 2.00% to 3.00% |

| Multiple currency support | No |

| Local Credit\Debit Cards Supported | Yes |

| International Credit\Debit Cards Supported | Yes |

| Netbanking Support | Yes |

| Activation Time | They claim that their online activation happens within 2 working days |

| Settlement time | They take around 3 days from the day of the transaction to settle. |

| Advanced Features | They offer both "Recurring Payments" and "Card Tokenization" as a feature. Sandbox or test account can be used to test your integration without having to actually charge credit cards. The Test Environment is an exact copy of the Production Environment, the only difference is that credit cards and bank accounts are not actually charged. |

| Customer Support | Seems to be pretty much a hassle-free experience from what other people say. |

| Integration effort | Fairly straightforward, examples provided on the site for major frameworks. |

| Technical Documentation on site for review | Extensive technical documentation has been provided on the site itself, can't really find any fault with it, is as good as it gets. |

CCavenue

CCAvenue is a trusted Online payment gateway service, they are one of the oldest payment gateways in India, it was launched sometimes in the year 2001, they support a wide variety of payment options:

Maximum Payment Options

- 7 Credit Cards

- 50+ Net Banking

- 98+ Debit Cards

- 12 ATM Cards

- 43 Bank's IMPS

- 13 Bank EMI

Their clientele list includes the who's who of the top e-commerce vendors.

| Setup Fees | Zero for Startup Pro Plan, Rs. 30,000 for Privilege Plan |

|---|---|

| Annual Fees | 1200 for Startup Pro from the 2nd year, It's 0 for the Privilege plan |

| Transaction Fees | 1.99% + 3.00 Rs to 2.99% + 3.00 Rs |

| Multiple currency support | Yes |

| Local Credit\Debit Cards Supported | Yes |

| International Credit\Debit Cards Supported: | Yes |

| Netbanking Support | Yes, they support almost all the banks out there |

| Activation Time: | They claim to activate your account within the hour however they do require a lot of documentation to do so. So it might realistically take a few days till everything is sorted out. |

| Settlement time | CCAvenue settles payments on a weekly basis or as per the terms in your agreement. they will remit all amounts over & above of Rs. 1000. That is, for the transactions shipped/executed by you until the Wednesday midnight cut-off, you will receive the payout settlement in the bank on Friday. |

| Advanced Features | On their site, they claim that they support both Recurring Payments and Card Tokenization, however, I wasn't able to get my hands on any technical docs explaining the same. They don't provide any sort of a Sandbox feature for testing either. Both of these things are major drawbacks. |

| Customer Support | It is not as great as you expect it to be. |

| Integration effort | Pretty simple, SDKs will be provided once you sign up. You will find plenty of unofficial GITHUB repositories for the same. |

| Technical Documentation on site for review | It's inadequate, couldn't find any documents on the site, you need to signup with them to get hold of anything. |

PayuBiz & Payumoney

PayU is one of the leading payment gateway service providers in India. they have architected different payment gateway products for catering to the needs of different users. PayU Biz and PayU money are two of its leading products in the market. PayU Biz is designed for enterprises and PayU money is designed for SMBs and individuals.

| Setup Fees | PayU Biz- Ranges from 4500 Rs to 19900 Rs as per the plan. PayU Money- No Setup Fees. |

|---|---|

| Annual Fees | PayU Biz- 2400 Rs. PayU Money- No Annual Fees. |

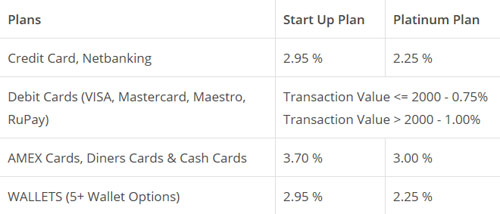

| Transaction Fees | PayU Biz - Ranges from 0.75% to 3.75% depending upon various factors pls refer to the infographic below for details  PayU Money - 2.00% |

| Multiple currency support | PayU Biz - Yes PayU Money - No |

| Local Credit\Debit Cards Supported | PayU Biz - Yes PayU Money - Yes |

| International Credit\Debit Cards Supported | PayU Biz - Yes PayU Money - Not by default, you will need to contact them |

| Netbanking Support | PayU Biz - Yes, commonly used banks are supported PayU Money - Yes, commonly used banks are supported |

| Activation Time: | PayU Biz - They require a lot of documentation, expect it to take around anywhere around 2 weeks + or so realistically. PayU Money - They get you started within minutes. |

| Settlement time | PayU Biz - They take around a single working day from the day of the transaction to settle. PayU Money - They take around two working days from the day of the transaction to settle. |

| Advanced Features | PayU Biz - They support Card Tokenization but not "Recurring Payments", so you should be able to implement your own. Sandbox feature provided for test purposes. PayU Money - They support neither Recurring Payments nor Card Tokenization. They do provide you a sandbox feature for you to test everything. |

| Customer Support | PayU Biz - Average PayU Money - Average Their systems seem to be fine but their customer support is not as responsive. |

| Integration effort | PayU Biz - You will need a full-fledged tech team to do this, PayU Money - Pretty trivial, you can get this done with very little effort. |

| Technical Documentation on site for review | PayU Biz - Pretty detailed documentation available on the website, they haven't spared any effort in documentation PayU Money - Detailed documentation provided on the site itself. |

EBS

EBS is a France-based company, whose business is to provide the technology involved in secure electronic transactions. They offer advanced payment gateway features. I Have seen some extremely negative reviews online, so they should certainly respond to the people complaining and resolve their problems.

| Setup Fees | No Setup Fees |

|---|---|

| Annual Fees | 1200 Rs. from the 2nd year. |

| Transaction Fees | Varies from 2.00% to 3.00% |

| Multiple currency support | Yes |

| Local Credit\Debit Cards Supported | Yes |

| International Credit\Debit Cards Supported | Yes |

| Netbanking Support | Yes, commonly used banks are supported |

| Activation Time | They claim to activate your account within 24 hrs. |

| Settlement time | EBS transfers the money to your bank two days from the day of the transaction. |

| Advanced Features | They support neither Recurring Payments nor Card Tokenization. |

| Customer Support | Strictly average. |

| Integration effort | Fairly straightforward. They provide you with an SDK when you are approved. Working examples can be found on the Internet pretty easily |

| Technical Documentation on site for review | The API documentation is provided on the site as a PDF for download. Their knowledge has code examples for most of the technology stacks. |

Conclusion

We have taken at look five popular payment gateways today and rated them according to their pricing and features. From the valuation matrix above InstaMojo and Razorpay appear to be clear winners here and are probably the best options for small to medium businesses when it comes to enabling payment options on their site. The others maybe no pushovers, but these guys will get you started with minimal hassles.

If you need to integrate any of these payment options to your website come to us for all your Payment gateway integration requirements.